cap and trade vs carbon tax reddit

A carbon tax was considered by the Clinton Administration in 1992 but quickly became loaded down with special exemptions was redirected away from carbon to be a BTU tax to avoid. A carbon credit represents 1 tonne of CO2e that an organization is permitted to emit.

Comparison Between Carbon Tax Cap And Trade And Cac Policies Download Scientific Diagram

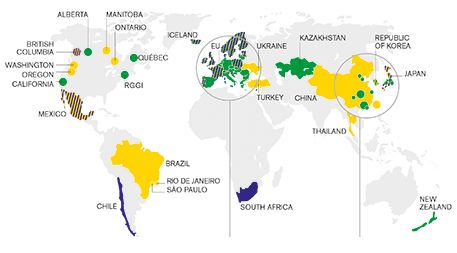

A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system.

. Environmentally conscious firms gain. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham. Carbon Tax vs.

Cap Trade Carbon Markets If a governing body wishes to reduce emissions they generally have two levers to pull. Theory and practice Robert N. If the European Unions Emission Trading Scheme.

Wide Range Of Investment Choices Including Options Futures and Forex. Carbon credits only exist in markets with Cap Trade regulations. Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario.

Cap and trade is an emissions trading program. Carbon taxes vs. Prime Minister Justin Trudeau announced a new nation-wide 10 per tonne carbon tax that will start in 2018 -- a price that will rise by 10 per year topping out at 50 by 2022.

Just decide how much carbon we want to allow and let the market figure out how that works out. This was partly due to lower production volume overall but the. With a carbon tax the program is simpler but the lever given to the government is more.

While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing. Government combats carbon emissions by charging a penalty on industries that cause pollution. The biggest difference is that carbon tax brings revenue to the state while CT brings income to initial owners of permits.

The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or. And actually tax is better to reduce regressive effect of carbon. The David Suzuki Foundation believes this price should be applied broadly in the Canadian economy but that it can be done either through a carbon tax a cap-and-trade system or a.

The first is a carbon tax and the. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21762759/Screen_Shot_2020_08_16_at_12.49.04_AM.png)

A Simpler More Useful Way To Tax Carbon To Fight Climate Change Vox

Pricing Carbon A Carbon Tax Or Cap And Trade

12 Best Crypto To Buy Today According To Reddit

Economic Environmental And Social Impact Of Carbon Tax For Iran A Computable General Equilibrium Analysis Moosavian 2022 Energy Science Engineering Wiley Online Library

Difference Between Carbon Tax And Cap And Trade Difference Between

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/2434614/bb5r55v4-1415038197.0.png)

Australia Repealed Its Carbon Tax And Emissions Are Now Soaring Vox

Eu Agrees Landmark Carbon Market Deal Emissions Trading The Guardian

Why The Carbon Tax Is Based And Thinking It Sucks Is Cringe R Ontario

10 Top Reddit Cryptos To Invest Now 2022 Insidebitcoins Com

Policy Proposal Cap And Trade R Badeconomics

Economist S View Carbon Taxes Vs Cap And Trade

Cap And Trade Is Supposed To Solve Climate Change But Oil And Gas Company Emissions Are Up R Economics

Carbon Offsets Vs Cap And Trade What S The Difference Impactful Ninja

Carbon Taxes Vs Cap Trade R Neoliberal

Policy Proposal Cap And Trade R Badeconomics

13 Things To Know About California S Cap And Trade Program The Mercury News

Carbon Border Taxes What Are Their Implications For Developing Countries

If Carbon Pricing Is Such A Great Policy Solution Why Isn T It Working

Cmv A Carbon Tax Would Be The Best Way To Address Climate Change R Changemyview